Property Tax In Spain 2022 . There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. Learn about property taxes in. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Effect of the new law on spanish property buyers. Capital gains tax (cgt) plusvalia tax. These include property transfer tax. On selling property in spain, you are liable for two taxes: When purchasing a property in spain, several fees and expenses must be considered. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when.

from barcelonasolicitors.com

On selling property in spain, you are liable for two taxes: These include property transfer tax. Capital gains tax (cgt) plusvalia tax. Learn about property taxes in. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. When purchasing a property in spain, several fees and expenses must be considered. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Effect of the new law on spanish property buyers.

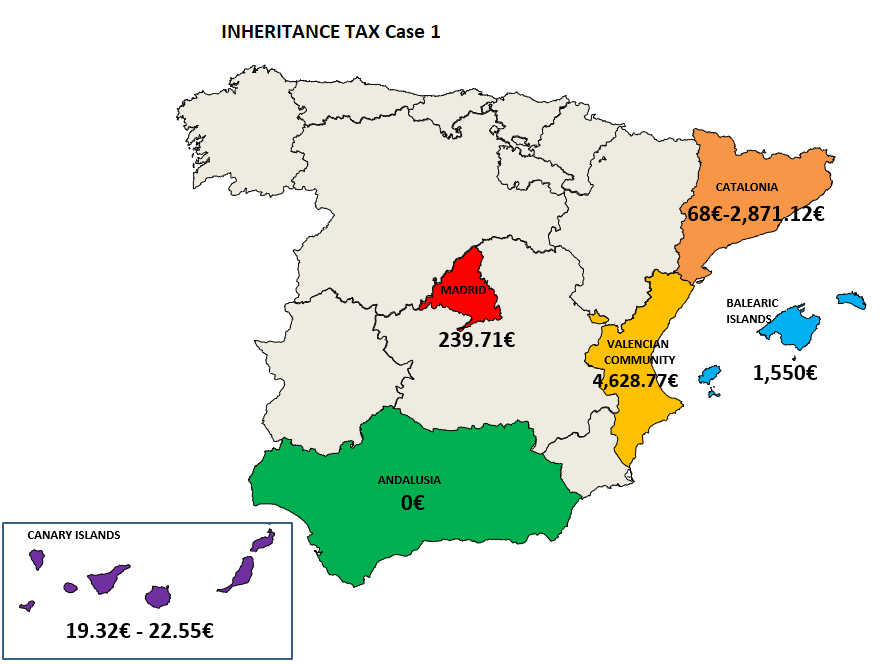

Inheritance and Gift Tax in Spain BarcelonaSolicitors

Property Tax In Spain 2022 On selling property in spain, you are liable for two taxes: In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. When purchasing a property in spain, several fees and expenses must be considered. These include property transfer tax. Capital gains tax (cgt) plusvalia tax. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. Learn about property taxes in. On selling property in spain, you are liable for two taxes: Effect of the new law on spanish property buyers.

From barcelonasolicitors.com

Inheritance and Gift Tax in Spain BarcelonaSolicitors Property Tax In Spain 2022 These include property transfer tax. In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. Starting this year the spanish tax. Property Tax In Spain 2022.

From taxfoundation.org

Top Personal Tax Rates in Europe, 2022 Tax Foundation Property Tax In Spain 2022 When purchasing a property in spain, several fees and expenses must be considered. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. Learn about property taxes in. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a. Property Tax In Spain 2022.

From homesenator.com

It is necessary to be prepared for this property taxes in Spain Home Property Tax In Spain 2022 Learn about property taxes in. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. These include property transfer tax. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. On selling. Property Tax In Spain 2022.

From www.dochub.com

City savings loan table Fill out & sign online DocHub Property Tax In Spain 2022 On selling property in spain, you are liable for two taxes: In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. Effect of the new. Property Tax In Spain 2022.

From thepropertyagent.es

Spanish Property Tax slashed making it a great time to buy a new home Property Tax In Spain 2022 Learn about property taxes in. Capital gains tax (cgt) plusvalia tax. When purchasing a property in spain, several fees and expenses must be considered. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. On selling property in spain, you are liable for two taxes: Effect of the. Property Tax In Spain 2022.

From balcellsgroup.com

How to File your Tax Return in Spain (With Useful Tips) Property Tax In Spain 2022 In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Capital gains tax (cgt) plusvalia tax. When purchasing a property in spain, several fees and expenses must be considered. Effect of the new law on spanish property buyers. There are different tax implications when you are buying,. Property Tax In Spain 2022.

From spectrum-ifa.com

Spanish CGT on UK Principal Residences The Spectrum IFA Group Property Tax In Spain 2022 Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. Capital gains tax (cgt) plusvalia tax. Effect of the new law on. Property Tax In Spain 2022.

From www.luxuryrealestatemaui.com

Maui Property Taxes Fiscal Year 2023 Tax Rates Property Tax In Spain 2022 There are different tax implications when you are buying, selling and owning a property, depending on whether you are a resident or non resident in spain. In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. Capital gains tax (cgt) plusvalia tax. These include property transfer tax.. Property Tax In Spain 2022.

From www.youtube.com

How is your rental Spanish property taxes for non residents Property Tax In Spain 2022 In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. These include property transfer tax. Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. Capital gains tax (cgt) plusvalia tax. Effect of the new. Property Tax In Spain 2022.

From www.iberiantax.com

What Is Spanish Tax Form 210 (Modelo 210) Property Tax In Spain 2022 In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. On selling property in spain, you are liable for two taxes: When purchasing a property in spain, several fees and expenses must be considered. As with purchasing property in any country, there are many additional expenses that. Property Tax In Spain 2022.

From makaansolutions.com

3 New Property Taxes to Impose in the Budget 202223 Property Tax In Spain 2022 Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. When purchasing a property in spain, several fees and expenses must be considered. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. On selling property in spain,. Property Tax In Spain 2022.

From www.ptireturns.com

Own a property in Spain? Learn about nonresident property taxes. Property Tax In Spain 2022 Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. Capital gains tax (cgt) plusvalia tax. When purchasing a property in spain, several fees and expenses must be considered. There are different tax implications when you are buying, selling and owning a property, depending on whether you are. Property Tax In Spain 2022.

From manzanareslawyers.com

How to file 2022 tax returns in Spain Property Tax In Spain 2022 Learn about property taxes in. When purchasing a property in spain, several fees and expenses must be considered. On selling property in spain, you are liable for two taxes: Effect of the new law on spanish property buyers. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. In 2022,. Property Tax In Spain 2022.

From taxfoundation.org

Spain Tax Rankings 2022 International Tax Competitiveness Index Property Tax In Spain 2022 Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. These include property transfer tax. Capital gains tax (cgt) plusvalia tax. In 2022, the vat payable on the. Property Tax In Spain 2022.

From neswblogs.com

2022 Va Tax Brackets Latest News Update Property Tax In Spain 2022 As with purchasing property in any country, there are many additional expenses that you need to allow for when buying. On selling property in spain, you are liable for two taxes: Learn about property taxes in. Effect of the new law on spanish property buyers. When purchasing a property in spain, several fees and expenses must be considered. There are. Property Tax In Spain 2022.

From taxfoundation.org

2022 Corporate Tax Rates in Europe Tax Foundation Property Tax In Spain 2022 Learn about property taxes in. Effect of the new law on spanish property buyers. On selling property in spain, you are liable for two taxes: Starting this year the spanish tax authorities are using a new formula to calculate the transfer tax that buyers must pay when. When purchasing a property in spain, several fees and expenses must be considered.. Property Tax In Spain 2022.

From howtobuyinspain.com

Spain property tax What are the taxes involved in the purchase Property Tax In Spain 2022 In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. On selling property in spain, you are liable for two taxes: These include property transfer tax. When purchasing a property in spain, several fees and expenses must be considered. Effect of the new law on spanish property. Property Tax In Spain 2022.

From www.youtube.com

The Nonresident Tax Scenario in Spain YouTube Property Tax In Spain 2022 Capital gains tax (cgt) plusvalia tax. In 2022, the vat payable on the purchase of a new property is 10% of its registered value, except in the canary islands,. On selling property in spain, you are liable for two taxes: As with purchasing property in any country, there are many additional expenses that you need to allow for when buying.. Property Tax In Spain 2022.